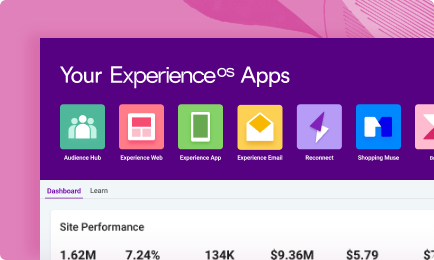

In order to show the most relevant, available offers, Synchrony decided to onboard its data from Liveramp – a data connectivity platform that gathers customers’ information for marketing purposes – into Dynamic Yield. The integration allowed the financial services company to deliver highly-personalized experiences based on CRM data. Using Liveramp, they were able break down audiences into segments according to a number of criteria, including (but not limited to) credit card type, how long the user has had their credit card, if they have signed up for e-billing, their first or last transaction, and the industry in which their brand-specific card falls into.

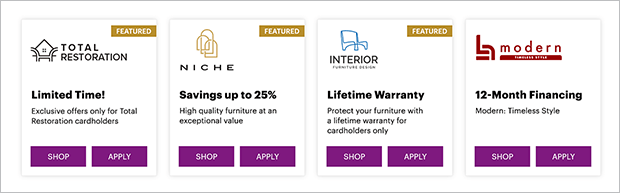

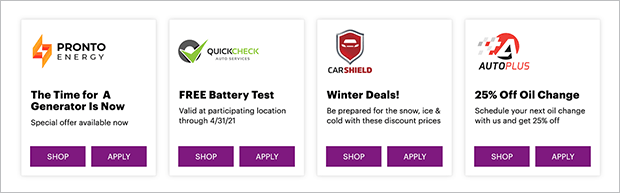

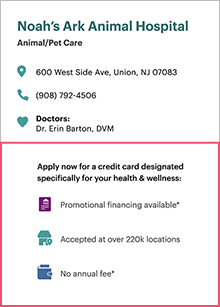

This data gives their team the power to reach first-time site visitors in a more personalized capacity to deliver relevant, engaging experiences rather than employing a simple, one-size-fits-all approach. Synchrony was then able to create relevant experiences based on what type of credit card a site visitor currently had. If a user visited the site and was not an existing customer, they were shown the site’s most popular offers and local offers. However, if a visitor was already a cardholder – say, for a national furniture retailer – they instead were shown more personalized offers based on their credit card type.

The team’s final action item was to decide where on the site to target visitors. Knowing the highest site traffic entry point was the homepage, they selected it as the starting point for recommendations, ensuring high engagement among users. This targeting strategy proved successful, with the organization witnessing a 12% increase in its click-through rate among cardholders.