Personalization is no longer a nice to have, deliver it faster with Experience OS

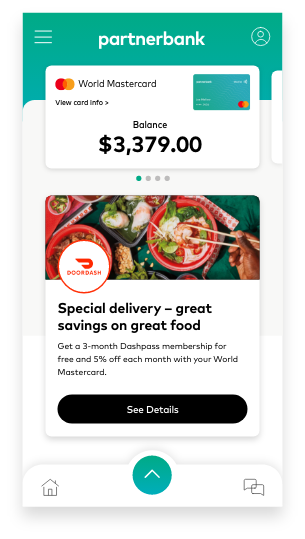

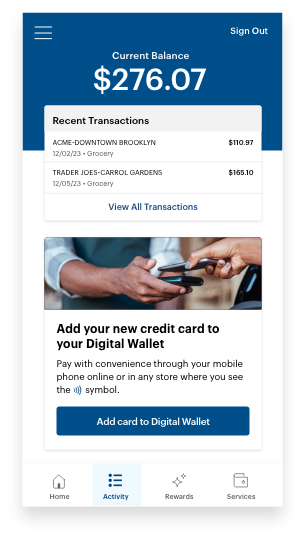

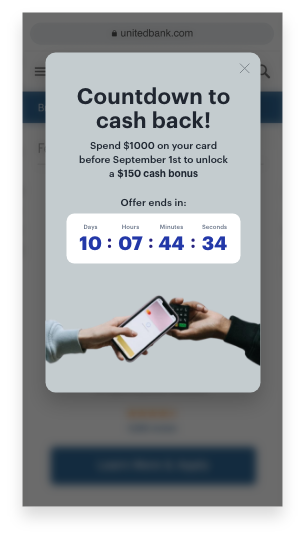

Scaling personalization drives better business outcomes, yet many financial services organizations struggle to meet their customer’s expectations for personalization. We built Experience OS to help, so you can build irresistibly personalized, optimized, and synchronized digital customer experiences faster and easier than ever before.

Join us, to:

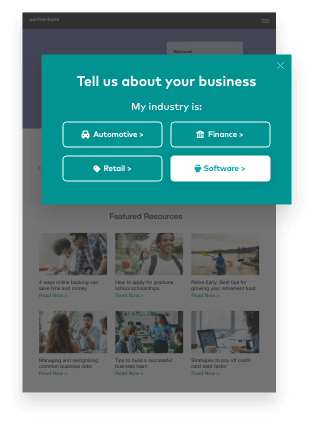

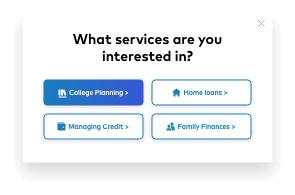

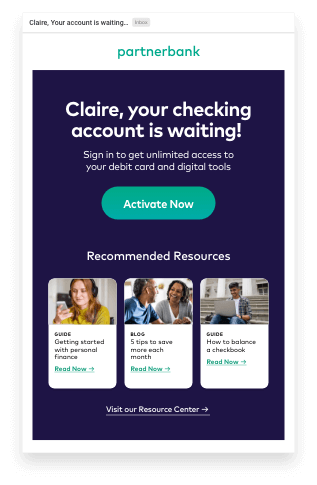

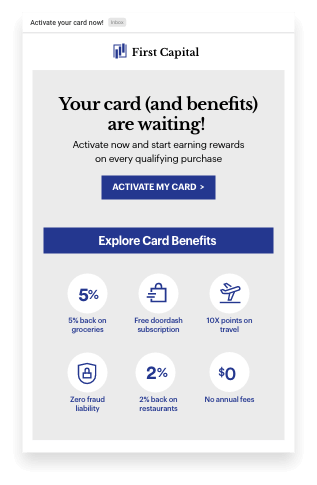

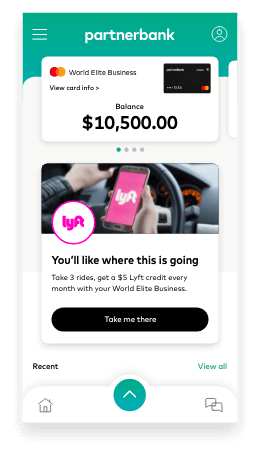

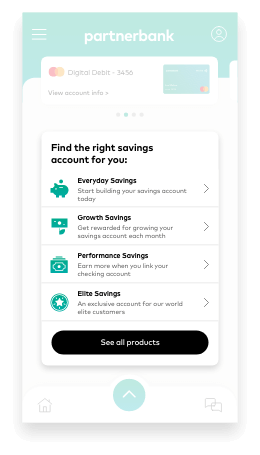

- Cater to your customers needs with personalized experiences, synchronized across the lifecycle

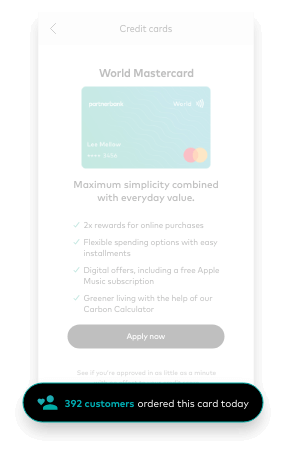

- Improve acquisition ROI with personalization from the very-first page view

- Maximize engagement and cross-promotion with continuous machine learning optimization

- Measure the impact of your program with FI-specific KPIs

- Accelerate experience delivery with templates and triggers tailor-made for FIs in an operating system designed to stay compatible with your existing tech stack